JEFFERSON CITY, Mo. — When the Missouri Legislature returns to the State Capitol on Wednesday for its annual veto session, leaders of the state’s cities, counties and school districts will be watching closely.

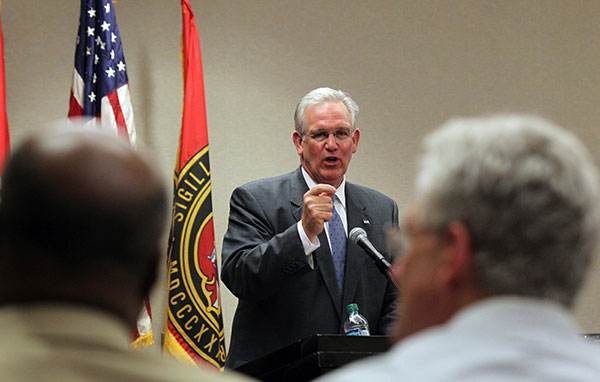

This summer, Missouri Gov. Jay Nixon vetoed a package of 10 bills with sales-tax exemptions that he has claimed will hit state and local sales tax revenue by $776 million annually. If he’s right, that would amount to more than a third of Missouri’s sales- and use-tax collections last year. Nixon’s administration has said more than $400 million of that could impact the state’s bottom line, while $351.4 million could come from money that was supposed to be sent back to cities.

“It is a kick in the teeth to us,” said Richard Davidson, mayor of Neosho, a town of 12,000 people in the southwest part of the state. Speaking at a town hall meeting this summer, the mayor told supporters, “our budget is sales-tax driven and I don’t remember them ever calling us.”

More at Government Executive.