JEFFERSON CITY, Mo. – Democratic Gov. Jay Nixon dispatched top aides on Wednesday as he began to law out his latest case against the legislature’s tax cut: What he sees as a fatal flaw in drafting that could eliminate much of the state’s tax base.

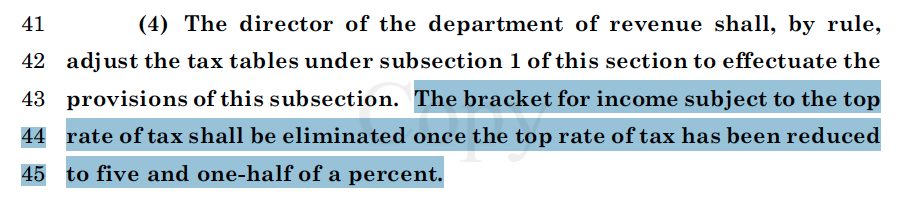

Ted Ardini, general counsel to the governor’s office, noted a provision that he interpreted as potentially eliminating the top income bracket, paid by all Missourians earning more than $9,000 a year. The bill reduces the top rate to 5.5 percent, and once it gets there, would eliminate the top provision. Nixon’s administration is arguing that the bill does not replace the provision with a new top rate.

“Once that hits 5.5 percent, this provision tells us to eliminate the top tax bracket. Once you eliminate the top tax bracket, it becomes over $8,000 and under $9,000,” he said. “If your Missouri income is greater than $9,000 you’d have no tax bracket and no tax rate.”

More simply, Ardini said, “by the elimination of the over $9,000 tax bracket, there’s nowhere to go.”

Nixon planned stops in Springfield, Kansas City, Jefferson City, and Columbia to “discuss action” on the provision, which State Budget Director Linda Luebbering said would have costed the state $4.8 billion in revenue if applied to tax year 2012.

House Majority Floor Leader John Diehl, R-St. Louis, is leading the Republican messaging in favor of the legislation, Senate Bill 509. He said the argument that the bill would eliminate the top bracket is “laughable,” and that the bill should be looked at in full when implemented by the Director of the Missouri Department of Revenue.

“You don’t get to cherry pick one sentence out of a multiple page bill and ignore everything else in the bill,” he said. “This is a diversion that’s intended to avoid talking about the real issue.”

Diehl said if the governor is against the bill, he should “veto it today. Why are you playing games and trying to scare people,” he asked.

Nixon appears to be waiting until the last possible day to take action on the bill in order to build public pressure on lawmakers to sustain his potential veto. Ardini said “15 days is not a very long time to do bill review with only 15 days left in session,” and said tax policy is complicated.

Why did the governor’s office not weigh in prior to the final vote on the bill in the House, where the legislation had not been changed since being seen in the Senate? Ardini said, “We don’t do bill reviews that are pending in the legislature.”

The overall bill, sponsored by state Sen. Will Kraus, R-Lee’s Summit, would reduce the maximum tax rate on personal income by from 6 to 5.5 percent beginning in 2017 and allow a 25 percent deduction of business income on personal tax returns. Both provisions would be contingent on state revenues being $150 million higher than the highest of the three prior years. The fiscal note for the bill claimed it could have a $620 million impact once fully implemented.